Best CMA Final Online Classes in Guntur & India

Why should you choose Master Minds for CMA Final classes? Led by visionary entrepreneurs, our institute adopts a progressive approach, ensuring your preparedness not just for exams but also for the complexities of the professional landscape. Certified professors in Guntur utilize advanced teaching methods, delivering a comprehensive learning experience available in both online and offline formats.

Whether you prefer the flexibility of online classes or the engagement of face-to-face interactions in our offline sessions, Master Minds caters to your unique learning style. Join us to benefit from our proven success record, innovative teaching techniques, and a curriculum designed to meet industry demands.

Why to Choose CMA Final Classes from Masterminds?

Why opt for Master Minds for CMA Final classes? Our certified professors, particularly in Guntur, employ innovative teaching methods, providing a holistic learning experience through our dynamic online platform and engaging offline sessions. This combination allows you the flexibility to choose the mode that aligns with your learning preferences.

Start a transformative educational journey with Master Minds, leveraging the advantages of both online and offline classes.

About CMA Final

| Group I | |

| Paper 1 | Corporate and Economic Laws (CEL) |

| Paper 2 | Strategic Financial Management (SFM) |

| Paper 3 | Direct Tax Laws and International Taxation (DIT) |

| Paper 4 | Strategic Cost Management (SCM) |

| Group II | |

| Paper 1 | Cost and Management Audit (CMAD) |

| Paper 2 | Corporate Financial Reporting (CFR) |

| Paper 3 | Indirect Tax Laws and Practice (ITLP) |

| Paper 4 | One of the following subjects: Strategic Performance Management and Business Valuation (SPMBV) Risk Management in Banking and Insurance (RMBI) Entrepreneurship and Start Up (ENTS) |

| CA Final Exam Pattern 2024 Paper Wise Weightage | ||||

| Groups | Papers | Marks | Types of Questions | |

| Group I | Paper-1: Corporate and Economic Laws (CEL) | 100 | Descriptive | |

| Paper-2: Strategic Financial Management (SFM) | 100 | Descriptive | ||

| Paper-3: Direct Tax Laws and International Taxation (DIT) | 100 | Descriptive | ||

| Paper-4: Strategic Cost Management (SCM) | 100 | Descriptive | ||

| Group II | Paper-1: Cost and Management Audit (CMAD) | 100 | Descriptive | |

| Paper-2: Corporate Financial Reporting (CFR) | 100 | Descriptive | ||

| Paper-3: Indirect Tax Laws and Practice (ITLP) | 100 | Descriptive | ||

| Paper-4: One of the following subjects: Strategic Performance Management and Business Valuation (SPMBV) Risk Management in Banking and Insurance (RMBI) Entrepreneurship and Start Up (ENTS) |

100 | Descriptive | ||

The Institute of Cost Accountants of India (ICMAI) prescribes the eligibility criteria for CMA Final exam on its official website. To register for the CMA final exam 2024, candidates should fulfill the following conditions-

- should have qualified the CMA Intermediate exam in the penultimate term (those who have passed CMA Inter in June will not be allowed to sit for CMA Final December)

- should have a valid registration number

- Should have completed prescribed training of the CMA Final course

- Should not be debarred from appearing in CMA Final course examination

Demo Lectures

CMA Final Courses

CMA FINAL BOTH GROUPS REGULAR || CC911

Original price was: ₹99,998.00.₹49,999.00Current price is: ₹49,999.00.CMA FINAL CORPORATE AND ECONOMIC LAWS REGULAR (CEL) || CC914

Original price was: ₹10,499.00.₹6,999.00Current price is: ₹6,999.00.CMA FINAL CORPORATE FINANCIAL REPORTING REGULAR (CFR) || CC919

Original price was: ₹10,499.00.₹6,999.00Current price is: ₹6,999.00.CMA FINAL COST AND MANAGEMENT AUDIT REGULAR (CMA) || CC918

Original price was: ₹10,499.00.₹6,999.00Current price is: ₹6,999.00.CMA FINAL DIRECT TAXES REGULAR || CC916

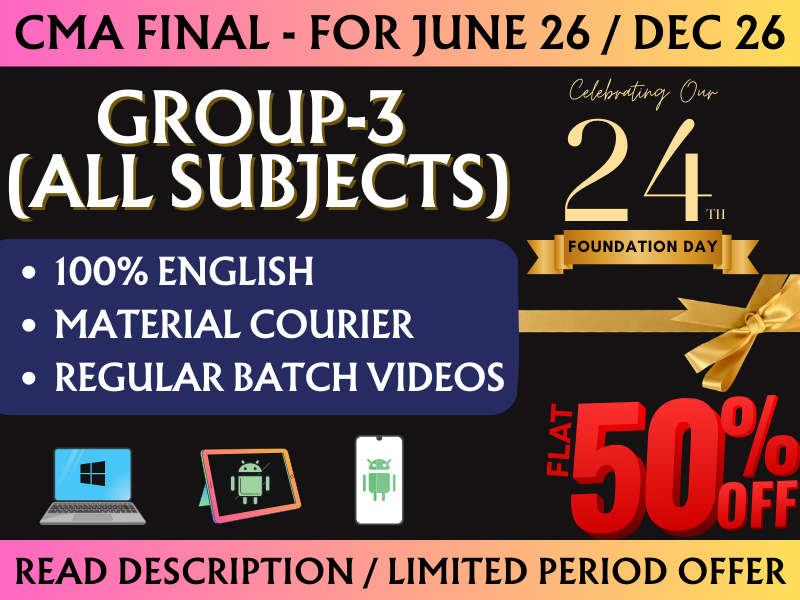

Original price was: ₹10,499.00.₹6,999.00Current price is: ₹6,999.00.CMA FINAL GROUP 3 REGULAR || CC912

Original price was: ₹51,998.00.₹25,999.00Current price is: ₹25,999.00.CMA FINAL GROUP 3 SUBSCRIPTION COURSE || CC942

Original price was: ₹7,999.00.₹5,999.00Current price is: ₹5,999.00.CMA FINAL GROUP 4 REGULAR || CC913

Original price was: ₹51,998.00.₹25,999.00Current price is: ₹25,999.00.CMA FINAL GROUP 4 SUBSCRIPTION COURSE || CC943

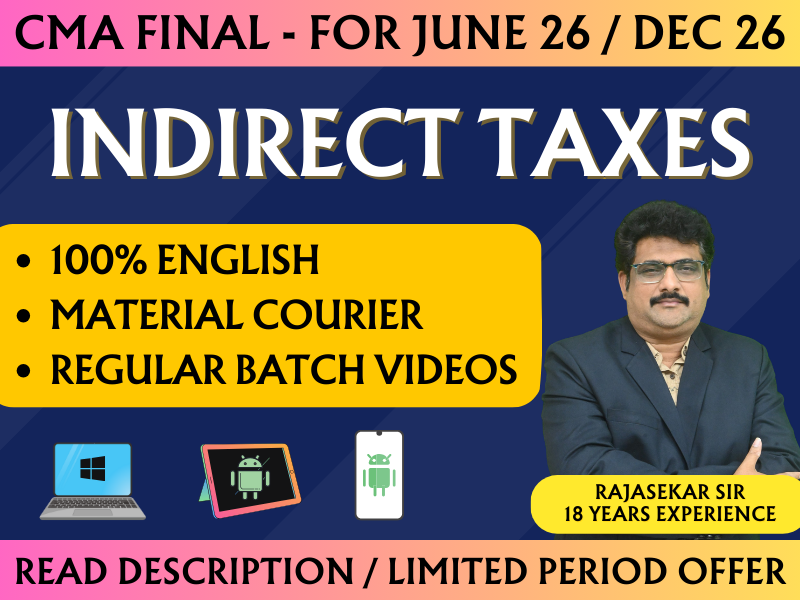

Original price was: ₹7,999.00.₹5,999.00Current price is: ₹5,999.00.CMA FINAL INDIRECT TAX LAWS REGULAR (IDLP) || CC920

Original price was: ₹10,499.00.₹6,999.00Current price is: ₹6,999.00.CMA FINAL MATERIALS GROUP 4 || CC952

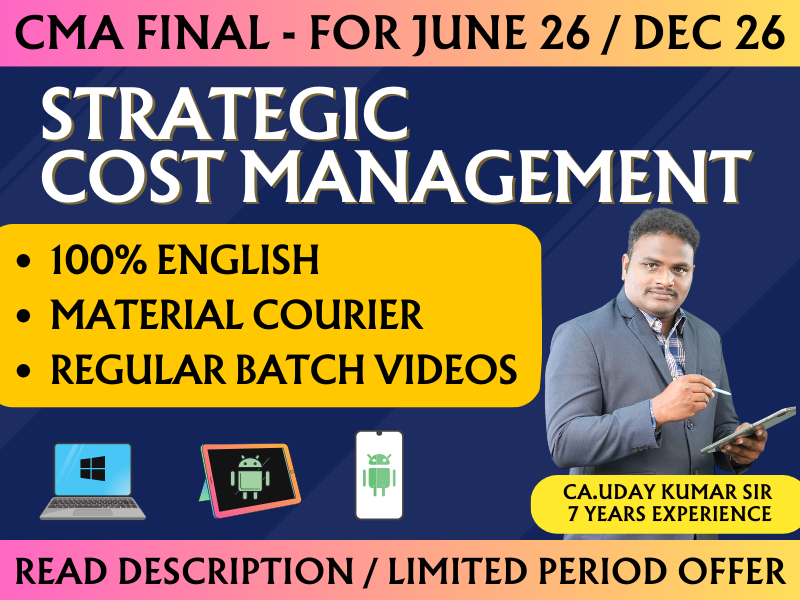

Original price was: ₹5,001.00.₹5,000.00Current price is: ₹5,000.00.CMA FINAL STRATEGIC COST MANAGEMENT REGULAR (SCM) || CC917

Original price was: ₹10,499.00.₹6,999.00Current price is: ₹6,999.00.

FAQs

CMA Final exam has two-course groups. Candidates can either appear for a single course group or both course groups in one session. The space below mention the test papers for both the course groups of the CMA Final exam:

Final Course Group – III

- PAPER 13: Corporate and Economic Lawns (CEL)

- PAPER 14: Strategic Financial Management (SFM)

- PAPER 15: Direct Tax Lawns and International Taxation (DIT)

- PAPER 16: Strategic Cost Management (SCM)

Final Course Group – IV

- PAPER 17: Cost and Management Audit (CMAD)

- PAPER 18: Corporate Financial Reporting (CFR)

- PAPER 19: Indirect Tax Lawns and Practice (ITLP)

- PAPER 20: One of the following subjects

- PAPER 20A: Strategic Performance Management and Business Evaluation (SPMBV)

- PAPER 20B: Risk Management in Banking and Insurance (RMBI)

- PAPER 20C: Entrepreneurship and Start Up (ENTS)

Determining the difficulty level between CMA and CA is subjective due to their distinct question patterns. While CMA modules offer guidance on exam questions, CA exams are more uncertain. CAs have broader market opportunities compared to CMAs. If you prefer CMA’s course structure, it’s advisable to pursue it.

The CMA syllabus doesn’t undergo annual changes. It was last updated in 2016 after the 2012 version. Recently, in 2022, the Institute of Cost Accountants (ICMAI) revised the syllabus to align with market trends, such as incorporating GST into the indirect taxation section. CMA students should prepare according to the updated syllabus provided by ICMAI.

ICMAI, the regulatory body for CMA courses in India, sets the syllabus and oversees exams for all three levels: Foundation, Intermediate, and Final. It is the sole authority for determining eligibility, fees, and certification. Completion of these courses leads to ICMAI certification, the only recognized CMA qualification for practice in India.

Join CMA Final classes and embark on a journey to success!

Easy And Conceptual Learning Experience for Exam Preparation